Exchange rate

£1 = ₱

Transfer fee

£

You pay

£

Maximize your padala!

Exchange rate

£1 = ₱

Transfer fee

£

You pay

£

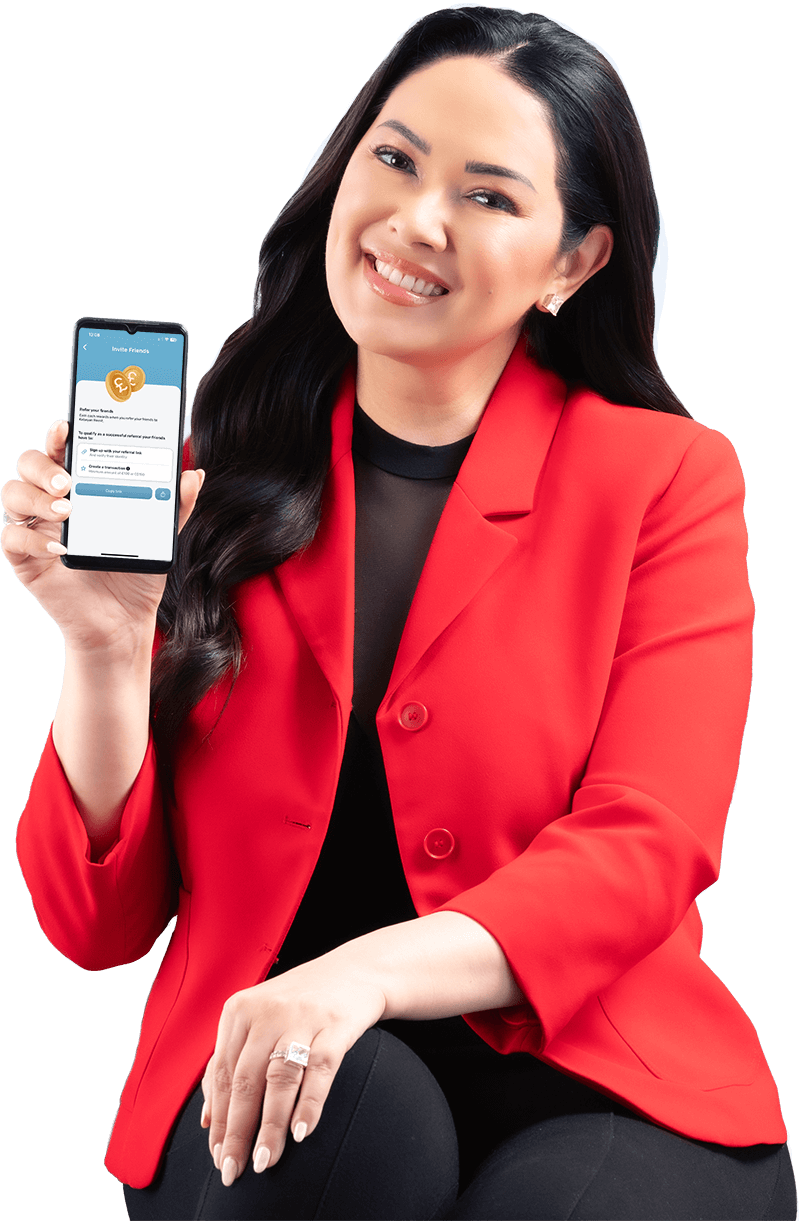

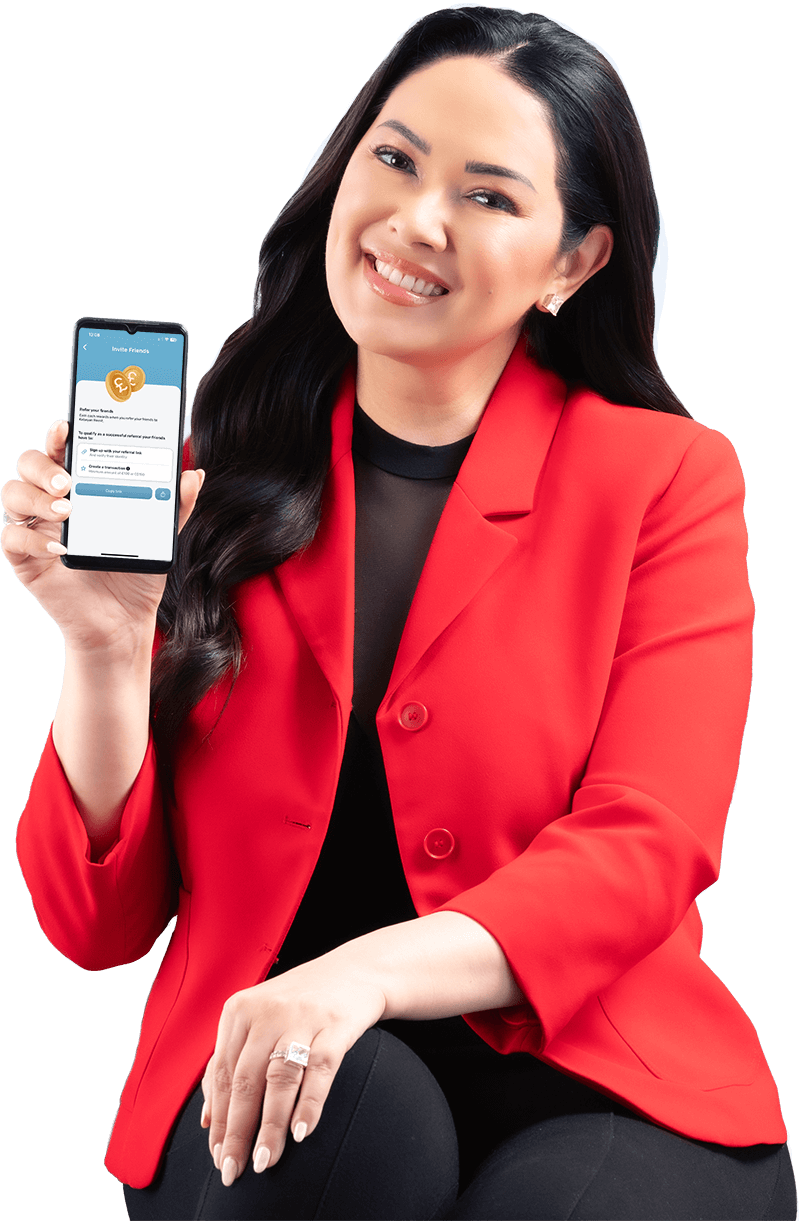

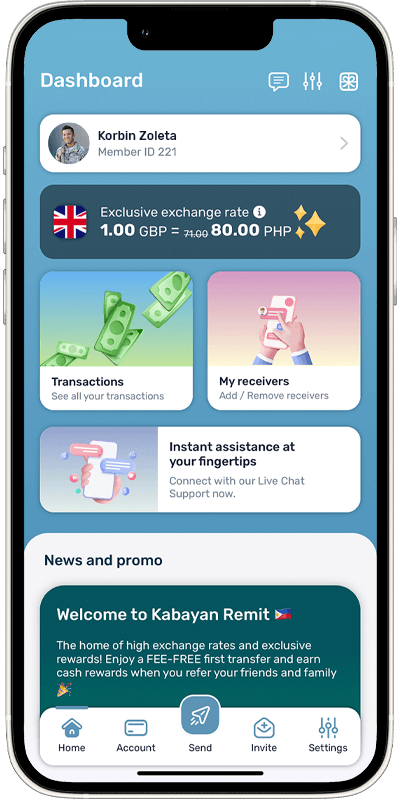

We offer a fast, secure, and convenient online money transfer service designed for Filipino remitters, making it easier to support your loved ones in the Philippines.

Join us in just a few taps – quick, simple, and all from the app.

Save your receiver’s details to make future transfers quicker and easier.

Enjoy high exchange rates, low fees and earn rewards with every transaction!

Choose the best way to get your money delivered.

Send money to any major Philippine bank account, hassle-free.

Transfer funds to over 10,000 cash pick-up locations in the Philippines.

Conveniently top up e-wallets like GCash, Maya, and many more.

Never miss a due date! Pay your contributions and bills with ease.

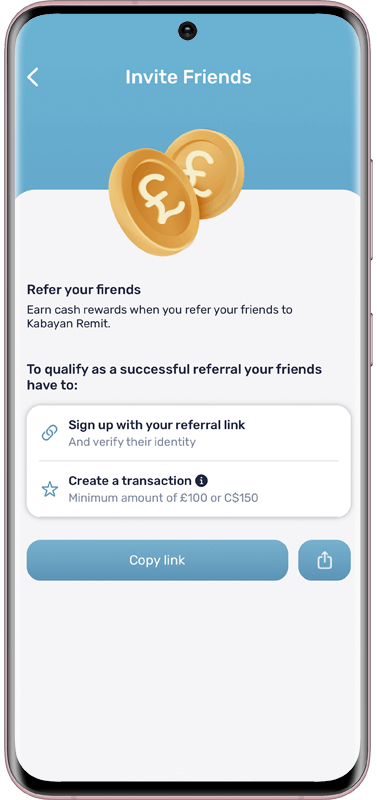

Sending love, made more rewarding - Earn points, claim discounts, and get a chance to win bigger prizes with every transaction!

Save time when you send money. Download our mobile app.

Transferring money to the Philippines should be quick, safe and convenient. We understand that time and accessibility are essential when choosing a money transfer service. That’s why we made remittances to the Philippines as easy and convenient as possible by providing you with different ways to send your money, how your beneficiary can collect it, and how long it would take for your funds to be credited.

Payment Methods

Delivery Methods

Send money to the Philippines directly to Metrobank, RCBC, BPI, BDO, PNB, Landbank or any other Philippine bank or cash collection outlets.

Here’s why thousands of our customers use our transfer money service.

Everything you need to know about sending money to the Philippines with Kabayan Remit.

You can send money online through the Kabayan Remit website or mobile app. All you need to do is register and create an account to start sending money on-the-go 24/7.

We provide a variety of payment and delivery options, so you can choose the most suitable way for you to transfer money to the Philippines from the UK, Canada and the US.

Depending on the country you are in, you can pay for your transaction through any of the following options:

You can also select the most convenient way for your beneficiary to receive the funds, as we offer the following delivery methods:

After payment confirmation, Kabayan Remit can usually deliver your money to the Philippines within an hour for most payment methods and 3-4 banking days after the transaction has been created for ACH transfers.

Yes, we are an authorised Money Service Business (MSB) regulated by the Financial Conduct Authority (FCA) in the UK and the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) in Canada. In the US, we are licensed in the states of Florida, Arizona, and Illinois. Delivering your hard-earned money to your loved ones safely and securely is our number one priority. Our world-class compliance policies and cutting-edge technology provide added protection to ensure your details and transactions are secure.

Yes, you can send money to over 11,000 cash pick-up locations across the Philippines. It’s a fast and convenient option if your beneficiary does not have a bank account or if they prefer to collect cash in an instant. Our payout partners include Metrobank, PSBank, LBC, Cebuana Lhuillier, MLhuillier, Palawan Pawnshop, Robinsons Department Store, Pera Hub, RD Pawnshop and Villarica.

Yes, you can send funds directly to your beneficiary’s bank account in the Philippines. Once your account is set up, you will only need to provide their bank details when you create a new beneficiary.

If you’re sending money with Kabayan Remit for the first time, we automatically waive your transaction fee. After this, the fees will vary depending on your selected payment or delivery method. Transaction fees start at £2.99 for the UK and $3.99 for Canada. You can also check the total cost by entering the amount you wish to send into the calculator tool.

Online money transfer is quick and straightforward with Kabayan Remit. Just follow this simple walkthrough:

That’s it! For most payment methods, delivery usually takes under an hour once payment is confirmed. For ACH transfers in the US, funds are usually received within 3-4 banking days after the transaction has been created.