Moving to Ireland: A guide for Filipinos

Relocating to a new country is exciting, but it can be challenging at the beginning. It’s not any different for Filipinos planning to migrate to Europe. Moving to Ireland is becoming a popular destination for expatriates and migrants. With plenty of opportunities to offer, this country is attractive for young professionals and families looking for a new home.

First things first, it’s essential to do your research about the country you’re moving to. Find out the requirements you need to prepare, get a grasp on the cost of living, and understand what you need to get settled in your new home.

To help our fellow Filipinos who are planning on moving to Ireland, we’ve laid out a few things to consider, including the following:

- About Ireland

- Legal Requirements for Filipinos to Stay in Ireland

- Financial Requirements and Cost of Living in Ireland

- Opening a Bank Account in Ireland

- Finding Accommodation in Ireland

- Understanding Health Care Coverage and Eligibility in Ireland

- Joining Filipino Communities

- Sending Money to the Philippines from Ireland

About Ireland

Ireland, aptly known as the Emerald Isle, is rich in lush and green sceneries, as well as a vibrant history. It is the third-largest island in Europe. It’s also worth knowing that its northern region, Northern Ireland, is a separate country of its own and is part of the UK.

You would need a UK visa to enter Northern Ireland and not an Irish visa. Here are some other helpful information about Ireland that you might want to know:

Official Name: Republic of Ireland

Capital: Dublin

Official Language: English and Irish

Total Population: 4.9 Million (Worldometer, 2020)

Immigrant Population: 535,475 (Central Statistics Office, 2016)

Population of Filipinos in Ireland: 1,000 – 10,000 (Central Statistics Office, 2016)

Weather: If you’re coming from the Philippines, prepare yourself for the coldest weather in Ireland. Unlike the Philippines, Ireland has four seasons – winter, spring, summer and autumn. It can also get rainy from time to time. In the summer, Ireland’s average temperature is around 18°C, and although it rarely snows in the winter, the temperature can go down to 4-6°C.

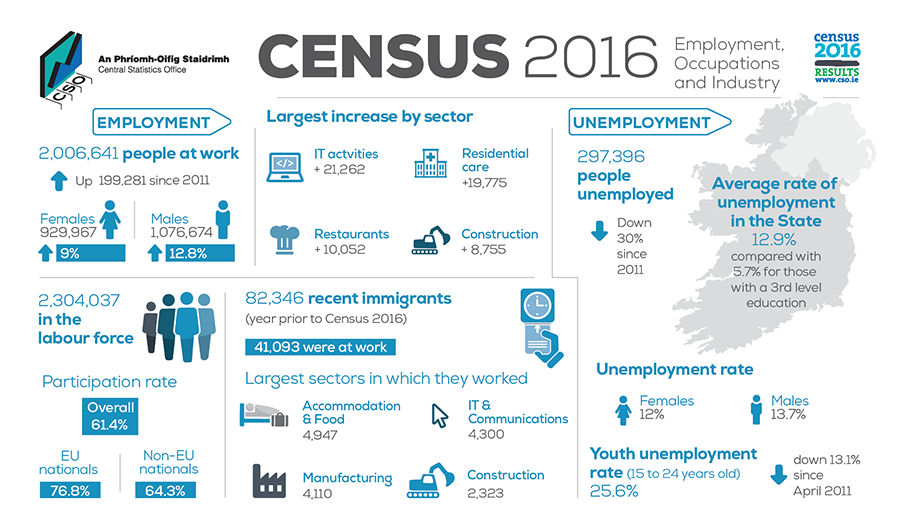

Employment: The Census 2016 infographic below from the Central Statistics Office shows a good representation of Ireland’s employment. As of 2016, 41,093 immigrants were at work. Some of the industries where most of them work include Accommodation & Food (Hospitality), IT & Communications, Manufacturing and Construction. The majority of Filipinos, on the other hand, work in the Health Services industry.

Legal Requirements for Filipinos to Stay in Ireland

Filipinos who wish to visit and of course moving to Ireland, will need a visa to enter the country. There are different types of visas you can apply for, depending on your reason for staying in Ireland.

If you plan to stay long-term, the visas you can consider include student, work, work as a researcher, internship, joining your family, volunteer, religious ministry or training course.

Make sure you apply for the appropriate visa to guarantee approval and ensure a smooth immigration entry. If you are moving to Ireland to work, make sure you secure a job first before applying for a visa.

For more information on the requirements for each type of visa, visit the Irish Naturalisation and Immigration Service (INIS) website.

Financial Requirements and Cost of Living in Ireland

Before you decide on moving to Ireland, make sure you’re familiar with the country’s standard of living, whether you choose to live inside or outside of the city.

Regardless, the cost of living in Ireland is significantly higher than in the Philippines. To give you an average estimate of how much it would cost to live in Ireland, we’ve listed down the average cost for some goods and services.

Accommodation (Monthly Rent)

City Centre

1 bedroom apartment: €1,236.20

3 bedroom apartment: €2,073.42

Outside the City Centre

1 bedroom apartment: €1,049.83

3 bedroom apartment: €1,649.10

Shared Accommodation (Monthly Rent)

City Centre

Per room: €600

Outside the City Centre

Per room: €400

Utilities (Monthly Bills)

Basic electricity, water for 85 sqm. apartment: €144.23

Internet: €50.75

Transportation

Monthly Pass: €120.00

One-way ticket: €2.60

Gasoline (per litre): €1.43

Groceries

White Rice (1kg): €1.50

Loaf of Bread (500g): €1.47

Milk (1L): €0.96

Eggs (1 dozen): €2.70

Chicken Fillets (1kg): €8.38

Beef (1kg): €9.22

For a more detailed estimate of the cost of other goods and services, please visit Numbeo.

Opening a Bank Account in Ireland

It’s essential to keep in mind that when you move to a new country, one of the first things you need to take care of is setting up a bank account. There are 68 banks you can choose from in Ireland, but some of the country’s major banks include Allied Irish Banks (AIB), Bank of Ireland, Ulster Bank and Citibank Europe. Before you open a bank account, do your research on which bank is the most suitable for you.

To open a bank account in Ireland, you would need to provide proof of identity (e.g. passport) and proof of address (e.g. utility bill). If you’ve only recently moved to Ireland, it’s understandable that you might not have proof of address yet. Some banks may allow you to use alternative documents, but make sure to check with them first beforehand.

Finding Accommodation in Ireland

Finding a new home is also one of the essential things you would need to get settled after moving to Ireland. You don’t need to worry since there’s plenty of houses and apartments you can choose from to rent. Getting an accommodation might be more pricey closer to Dublin than further away. If you wish to live outside the city, Ireland has excellent transport links so travelling in and out of the city shouldn’t be a problem.

Before you fly to Ireland, you can start looking for accommodations even if you’re in the Philippines. Make sure to check out various websites since they are more likely to post different listings. You can get in touch with property agents and landlords online to get started on your property search.

Understanding Health Care Coverage and Eligibility in Ireland

Health services in Ireland have two tiers – public and private. The public Irish health care system is governed by the Health Service Executive (HSE) and is often free of charge. However, to become eligible for the free public health care services, you must prove that you are “ordinarily resident in Ireland”. To be considered an “ordinarily resident”, you must prove that you have either lived in Ireland for at least a year or have intentions to stay in the country for a minimum of one year. Once confirmed eligible, you will be entitled to benefits under one of the two categories:

Category 1 (Individuals with Medical Cards) – These are people with full eligibility to the public healthcare system. They can access a wide range of health services and medicine for free.

Category 2 (People without Medical Cards) – Under this category, individuals only have limited eligibility, which means they have access to free or reduced cost to health services. To find out more about hospital charges, click here.

Join Filipino Communities

To feel at home despite being away from the Philippines, you can join Filipino communities. According to the Philippine Consulate Dublin, there are 50 active Filipino communities across Ireland. Though many of them are in Dublin, there are also some organisations based outside the capital. To find out more about the different groups and communities, you can get in touch directly with the Philippine Consulate Dublin.

Alternatively, you can also join online communities. The easiest way to find them is through Facebook. There’s a long list of Filipino community groups on Facebook, where members actively engage with one another. To get started, you can join the “Filipino Kababayan in Ireland” Facebook group, which we manage ourselves.

Sending Money to the Philippines from Ireland

Once you’re already settled in Ireland, you might want to send money back to your loved ones in the Philippines. International money transfers can be costly, especially when you send money through traditional banks and remittance centres.

To make it more convenient and affordable for you, our fellow kababayan, we offer an online money transfer service that’s safe and easy-to-use. All you need to do is register online free of charge on our website or mobile app (iOS or Android). Once registered, you can send money 24/7. It’s all done online, so you wouldn’t have to physically go to banks and remittance centres to transfer your money.

If you need assistance setting up your account or if you have questions regarding our services, you can call us on +353 766 805 573 any time of the day to speak to our bilingual customer service representatives, with the well known Filipino hospitality.